How much is windfall tax UK

Help with energy bills

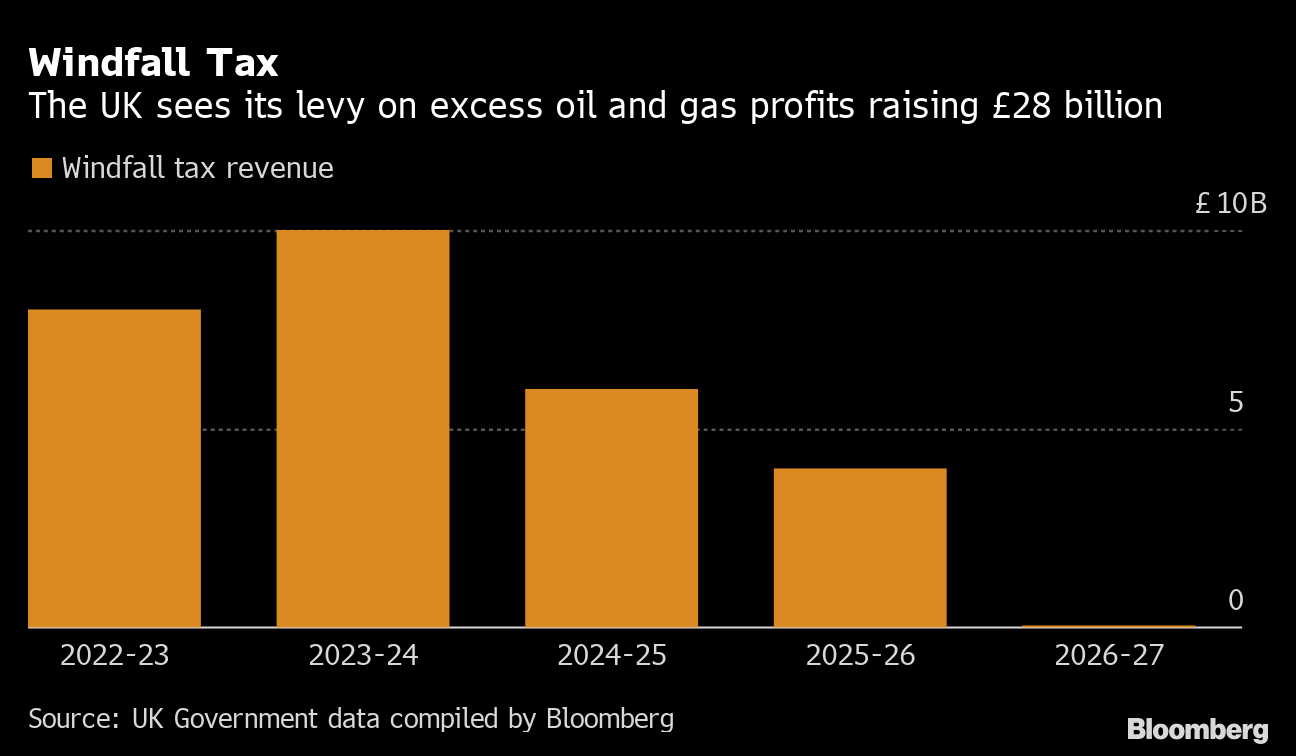

In May 2022, the government introduced a 25% windfall tax on the profits of oil and gas producers operating in the North Sea, upping the levy to 35% six months later.

What is an example of a windfall tax in the UK

One of the most famous examples of a windfall tax in the UK was one announced by then-Chancellor Gordon Brown in 1997 when the privatised utilities were hit for around £5bn to pay for New Labour's "welfare to work programme".

How does UK windfall tax work

The windfall tax also allows energy companies to apply for tax savings for every £1 invested in fossil fuel extraction in the UK, encouraging them to make investments in the British energy supply. The tax, at the moment, does not apply to any electricity companies who generate their power from wind or nuclear.

What is windfall windfall tax

A windfall tax is used to target firms which benefit from something they were not responsible for. It was introduced last year to help fund a scheme to lower energy bills for households and businesses.

How much tax has Shell paid in UK

Despite windfall tax and record profits, Shell paid just £15 million to UK, 22p per Brit last year | Global Witness.

How much money does the UK make from North Sea oil

Between 2022-23 and 2027-28, North Sea oil and gas receipts are forecast to average £8.6 billion, up from an average of just £0.8 billion over the six years to 2021-22.

Who pays windfall tax in UK

The levy applies to profits made from extracting UK oil and gas, but not from other activities, such as refining oil and selling petrol and diesel on forecourts.

Who benefits from windfall tax UK

Windfall taxes are usually levied on companies judged to have benefited from something that was not the result of their own investment or hard work, at the expense of wider society, so the tax provides a way of redistributing these gains.

Why is it called windfall

A: “Windfall” originally was indeed wind-powered, referring to branches or fruit blown down by the wind from the tree.

What is an example of a windfall gain

For example, an individual who wins a lottery doesn't gain profits through a business transaction, but an event that happened externally to them. Another example of windfall gains happening to an individual includes inheriting a fortune or valuable property.

Why do Shell not pay tax in UK

The company has explained the low sums paid out to the Treasury under the windfall levy by saying the UK as a market presents “less than 5%” of global revenues. And managers stress Shell pays all taxes due.

Who pays the most tax in the UK

The highest taxpayers in Britain include a scrap metal dealer, an athleisure tycoon from Bromsgrove, JK Rowling, the boss of Wetherspoon, Sting and the Duke of Westminster.

Why does the UK not use the oil from the North Sea

The practical limitations of new North Sea production

Here's why. Oil-heavy basin: The geology of the North Sea means that, after nearly 50 years of production, 70% of what's left in the basin is oil not gas – and not the type of oil that we use in UK refineries, which means that we export 80% of it.

Is Britain self sufficient in oil

The United Kingdom has proven reserves equivalent to 4.8 times its annual consumption. This means that, without imports, there would be about 5 years of oil left (at current consumption levels and excluding unproven reserves).

Why does Shell pay no tax in the UK

No figures yet on how much of that $22bn of tax will be paid in the UK, but it's likely very small. Why Because only 5% of Shell's business is in the UK. The rest is abroad, and we don't tax that.

What is the energy profit levy in the UK

Energy Profits Levy (EPL) is a temporary levy introduced with effect from 26 May 2022 on the profits of companies producing oil and gas in the UK or on the UK Continental Shelf.

How much money is considered a windfall

A cash windfall is any amount of money that you didn't expect to receive and is over your regular income. Most would consider it to be any amount over $1,000 – and quite often, the amount of money is much more than that.

What is windfall money examples

Types of financial windfallsWinning the lottery.Inheritance or life insurance payout.Big successes in investing.Selling assets like a property or business.Injury or lawsuit settlement.Spending too much too fast.Not thinking about taxes.Being too generous.

Is windfall a good thing

A financial windfall can increase your financial flexibility. Prioritizing your most important needs will help ensure that you make effective use of your newfound cash. Paying down debt can free up cash to meet your longer-term goals. A financial windfall can be an opportunity to increase your retirement savings.

Who pays no tax in UK

You do not pay tax on things like: the first £1,000 of income from self-employment – this is your 'trading allowance' the first £1,000 of income from property you rent (unless you're using the Rent a Room Scheme) income from tax-exempt accounts, like Individual Savings Accounts (ISAs) and National Savings Certificates.

What are the 4 main taxes paid in the UK

Overview. Income tax forms the single largest source of revenues collected by the government. The second largest source of government revenue is National Insurance Contributions. The third largest source of government revenues is value added tax (VAT), and the fourth-largest is corporation tax.

How much tax do the top 1% pay in the UK

Further background on Income Tax rates in the UK

Despite the reduction in the additional rate from 50% to 45% in April 2013, the share of total Income Tax liabilities accounted for by the top 1% of taxpayers by income rose from 25.1% (£39bn of £157bn total) in 2012-13 to 28.3% (£71bn of £251bn total) in 2022-23.

Is UK self sufficient in oil

The United Kingdom has proven reserves equivalent to 4.8 times its annual consumption. This means that, without imports, there would be about 5 years of oil left (at current consumption levels and excluding unproven reserves).

Why can’t UK rely on North Sea gas

Why doesn't the UK just drill more gas and oil from the North Sea The major reason that the UK doesn't increase its domestic supply of gas and oil is due to prioritising the UK's energy security.

Why doesn t britain use its own oil

The major reason that the UK doesn't increase its domestic supply of gas and oil is due to prioritising the UK's energy security. For instance, some estimations, although disputed by others indicate that the North Sea's gas reserves will be depleted by around the year 2030.